The housing market has been hot/booming/fiercely competitive for some time now, with prices/valuations/costs soaring/climbing steadily/increasing at an alarming rate. However/But/On the other hand, there are signs/indicators/growing concerns that this trend/fever pitch/momentum may be cooling down/about to reverse/coming to an end. Mortgage rates/Interest rates/Loan costs have been rising/climbing/increasing, making homes/properties/real estate less affordable/more difficult to purchase/out of reach for many. Experts/Analysts/Economists are divided/split/offering mixed opinions on whether a crash is imminent/likely/possible, but the current/present/ongoing market conditions certainly/definitely/undeniably warrant attention/caution/further observation.

Some/Certain/A growing number of experts point to/attribute this/suggest that a combination of factors/elements/influences, including rising interest rates, inflation, and economic uncertainty, are creating/contributing to/driving the potential for a correction/crash/market downturn. Others/Meanwhile/Conversely, remain optimistic about/believe in/hold onto the long-term strength/stability/potential of the housing market.

Only time will tell what the future holds/ultimate outcome will be/path ahead looks like for the housing market. In the meantime/Until then/For now, it is important for buyers/homeowners/consumers to be informed/stay updated/do their research and make decisions that are right for them/consider all factors carefully/protect their interests.

Predicting the 2025 Housing Market: Boom or Bust?

As we gaze on the horizon of 2025, the likelihood of a property explosion or a bust looms large. Experts are scrutinizing a myriad of variables, including loan expenses, job market performance, and inflation. Some predict a increase in demand driven by first-time buyers, while others warn of a stabilization due to inflationary pressures.

Ultimately, the future of the 2025 housing market remains indeterminate. The next year will undoubtedly bring clarity on the true trajectory of this dynamic sector.

forecast Housing Market 2025: What to await for Buyers and Sellers

As we draw near 2025, the housing market is poised for some shifts. Purchasers can anticipate a market that might become be intense, while sellers will need to strategize their tactics.

The desire for housing will likely robust, but trends such as interest levels and the economy could influence price fluctuations. Those looking to buy may find it helpful to remain flexible with their needs, while sellers who offer attractive terms will have an advantage.

Factors such as digital advancements could also shape the future on how people sell real estate. Virtual tours, online platforms, and data-driven insights will likely continue to. Ultimately, the housing market in 2025 will be a complex environment, offering both possibilities for buyers and sellers.

The Future of Real Estate: Will Prices Continue to Climb?

The real estate market has experienced dramatic growth in recent years, leading many to wonder about its future trajectory. Will prices soar even higher? Analysts offer varied perspectives on this timely issue. Some forecast that demand will persist, driven by factors such as population growth and low interest rates, suggesting continued price appreciation. However, others caution that the market may be reaching a peak, with potential for stabilization in the coming years.

- Furthermore, external factors such as economic fluctuations and government policies can impact real estate prices, adding to the nuance of forecasting future trends.

- Finally, determining whether real estate prices will continue to climb requires careful evaluation of a multitude of overlapping factors.

Indicators a Housing Market Crash is Imminent

Are you witnessing the onset of a housing market freefall? While nobody can predict the future with certainty, there are certain indicators that point towards a potential downturn. A sharp spike in interest rates can put buyers on the outskirts, leading to reduced demand. Similarly, an surplus of unsold homes on the market can indicate a weakening purchaser's market. Keep an gaze out for those warning signs.

- Increasing foreclosure statistics

- Falling home costs

- An abrupt drop in buyer interest

It's important to remember that the housing market is a complex system, and any single element alone may not necessarily indicate an impending crash. Nevertheless, paying attention to these clues can assist you in making informed selections regarding your real estate holdings.

Conquering the Volatile Housing Market in 2025

Predicting the future of the housing market is always a challenge. In 2025, this forecast becomes even more nuanced due to several influencing factors. Economic pressures continue to impact affordability, while fluctuating interest check here rates create uncertainty for potential buyers and sellers. Additionally, demographic shifts are redefining housing demands.

To steer clear of this volatile market, it's crucial to stay informed. Engaging with experienced real estate professionals who possess a deep understanding of the local market is indispensable. By staying flexible and making informed decisions, individuals can minimize risks and harness opportunities within this shifting housing market.

Barret Oliver Then & Now!

Barret Oliver Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Andrea Barber Then & Now!

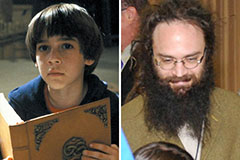

Andrea Barber Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now!